Missouri Solar

If you live in Missouri and are interested in a rooftop solar system from your home or small business, you’re in luck. Missouri has more than 200 sunny days per year according to the U.S. Department of Energy’s National Renewable Energy Laboratory. On average, each square meter in the state can provide up to 5 kilowatt hours of energy every day. NREL’s PVWatts is a great program for determining the solar resource at your location and the expected energy output of a solar PV system.

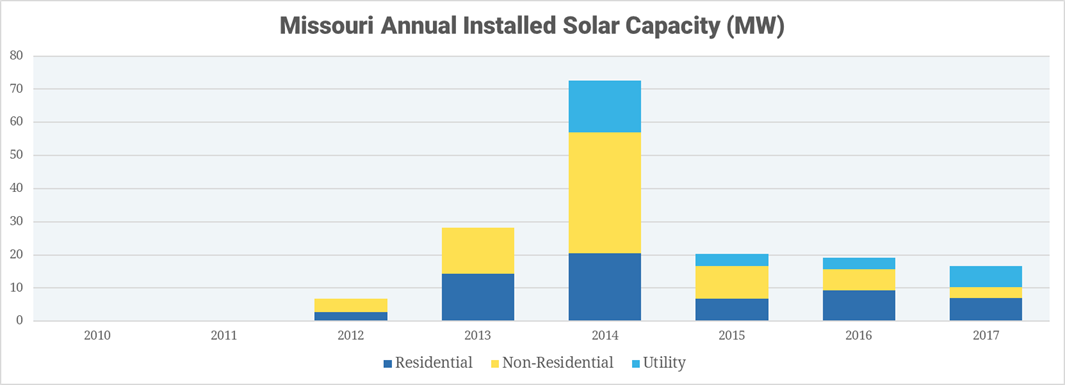

Missouri has a statewide mandate to derive 11% of is electrical energy from renewable source by 2020. Many states have more ambitious renewable energy standards; some have none at all.

Federal Tax Credit

If you install a solar energy system at your home in Missouri before the end of 2019, you will be eligible for the federal investment tax credit of 30%. A typical home solar installation costs around $15,000 — some are more and some are less. That means you can qualify for a tax credit of $4,500, making the net cost of the system to you only $10,500.

If you don’t owe $4,500 in federal taxes, the unused portion of the credit can be carried over to later tax years. Thanks to the federal credit, the system will pay for itself in about 9 years or less. After that, it will provide you and your family with free electricity for the entire balance of its useful life, which is typically 25 years.

Net Metering

Missouri has recently enacted policies that require utility companies to compensate customers for any excess electricity they put back into the utility grid. In some states, the customer receives a fixed rate for the electricitry they provide. In Missouri, the process works a little differently.

Instead of being paid directly, utility customers with rooftop solar systems smaller than 100 kilowatts (most are typically between 5 and 15 kilowatts) receive credits for their excess energy. They can draw on those credits the following month to reduce the cost of their utility bills. But there is a caveat. Any unused credits remaining at the end of the year cannot be carried over. They revert to the utility company.

Income Tax Deduction

Missouri allows taxpayers to deduct the cost of home energy audits and energy improvements. The deduction is limited to $1,000 for single taxpayers and $2,000 for married couples. To qualify, the homeowner must not have also received any incentive or rebate through the state of Missouri or any utility company provided incentive. Unless renewed, the deduction will expire December 31, 2020.

Property Tax Relief

A rooftop solar system obviously adds value to your home. Ordinarily, that increased value would cause your property taxes to rise. But Missouri law forbids local jurisdictions to tax the value of a residential solar system. That means you can make your home worth more without paying more in property taxes.

Several utility companies serving communities in Missouri offer local rebates to people who install rooftop solar systems. Columbia Water & Light offers a rebate of $500 per kilowatt of solar power generation capacity up to 10 kilowatts.

Kansas City Power & Light offers a rebate of $1.00 per watt on roofop solar systems that particiapte in its net metering program. The applicable rate may vary depending on your location within the KCP&L service area and application date, so be sure to check with the company for specific details.

Empire District Electric offers solar rebates of up to $2.00 per watt. The actual rate varies depending on several factors, so once again, contact the company directly for more information.

Act Now!

With so many incentives for rooftop solar systems on offer to Missouri residents and the cost of solar systems at all time lows, now is the time to join the clean power revolution before some or all of those incentives disappear.

Leave a Reply

Solar Savings Calculator

Get the facts. Find out exactly how much solar will save you, including which Tax and Financial programs you qualify for!